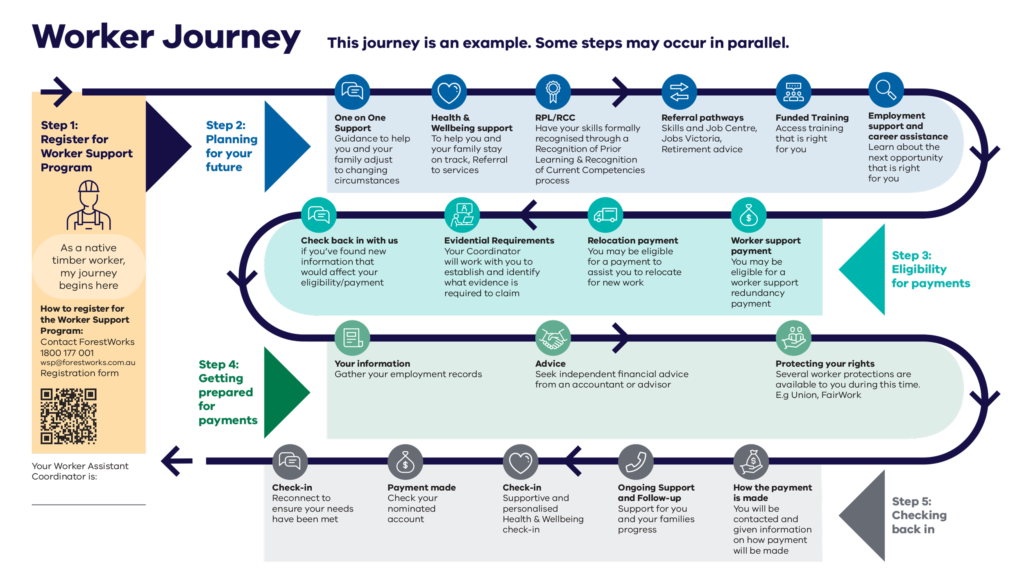

Support for Victorian Forestry & Timber Workers

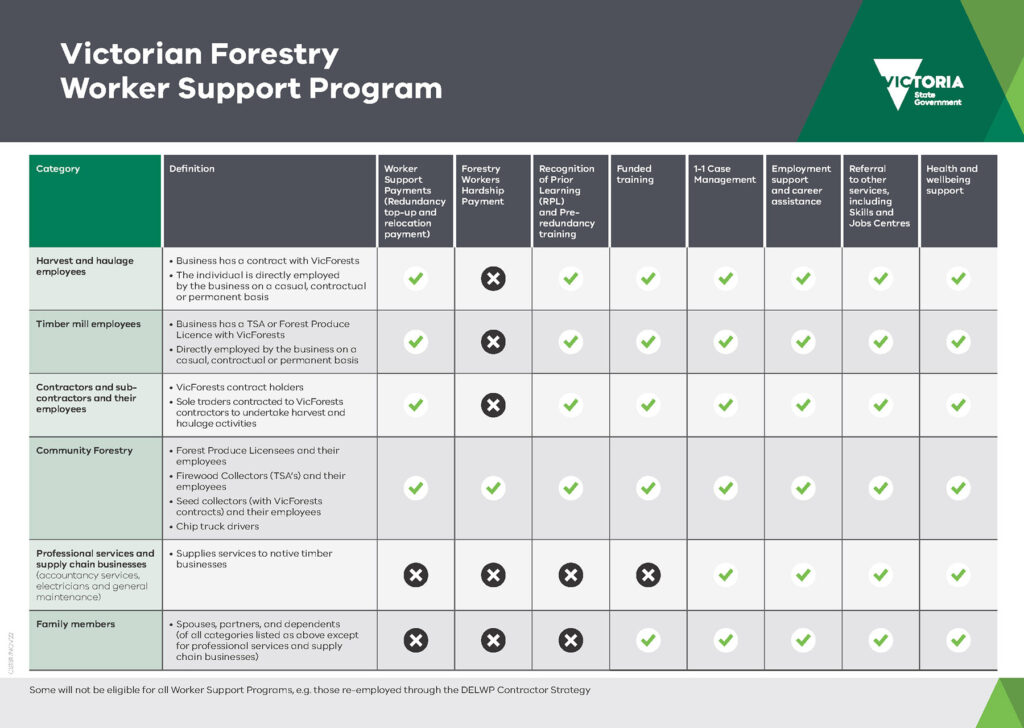

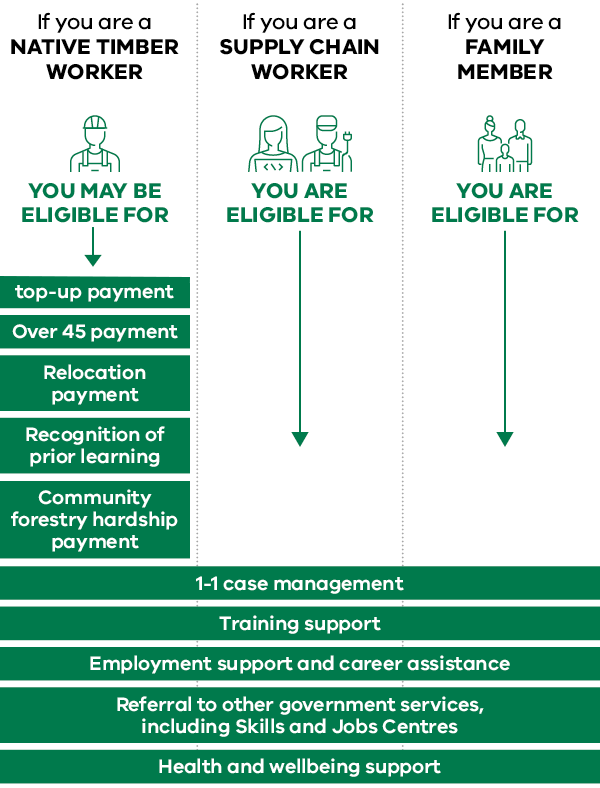

All workers employed in the native timber industry can access the Worker Support Program including:

This includes direct employees, casual or temporary employees, VicForests Harvest and Haulage contractors, their sub-contractors, and sole traders.

Worker Support Program

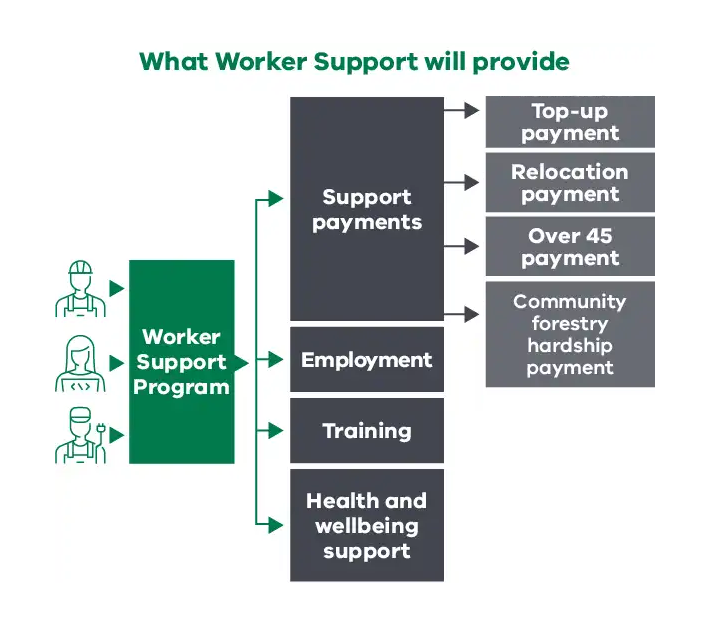

Under the Worker Support Program (WSP) if you are made redundant you may be entitled to Support Payments.

Worker Support payments can only be accessed when a worker is made redundant or does not have their contract renewed because of the Sawmill Opt-out Scheme or mill closure or business downsizing as a result of VicForests Timber Sales Processes.

Support Payments – Top up payments for workers

Workers will receive a top up payment of up to $150,000 which includes:

Support Payments – Over 45 payment

Workers over 45 are eligible for an extra 3 weeks pay for every year they have worked since turning 45 years, capped at $50,000.

Support Payments – Community Forestry Workers Hardship Payment

Community Forestry Workers will be eligible for a $3,000 hardship payment.

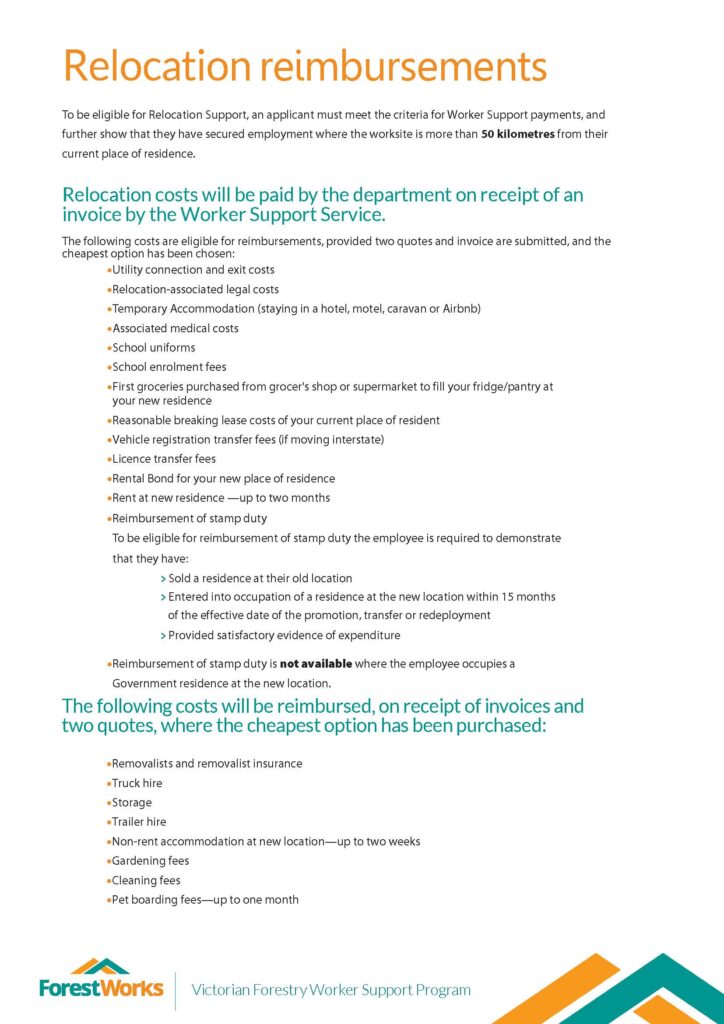

Support Payments – Re-location support

Employment

We will provide dedicated one-on-one support with employment skills, resume writing, application support and more

Training

We will assist you with:

Health and Wellbeing Support

Your health and wellbeing are our top priority. We can assist by giving mental health contact and referrals